Last night I watched Moneyball . The film is based on the 2003 nonfiction book by Michael Lewis, an account of the Oakland Athletics baseball team’s 2002 season and their general manager Billy Beane’s attempts to assemble a competitive team. In the film, Beane (Brad Pitt) and assistant general manager Peter Brand (Jonah Hill), faced with the franchise’s limited budget for players, build a team of undervalued talent by taking a sophisticated sabermetric approach to scouting and analyzing players. Of course there was pushback from others inside the organization because that is “not the way that it is done”. It got me thinking about other biases we may have in the gymnastics world that effect our decisions. Then other day I wrote about Survivor’s Bias and the Peter Principle , two concepts which EVERYONE in the gymnastics world needs to be aware of.

We all have biases. They’re our brain’s way of reducing the energy it takes to deal with the terabytes of information thrown at us every day. We connect the dots, fill in the gaps with stuff we already think we know, to then act as fast as we can. Great for avoiding sabre-tooth tigers. Not great for solving problems in the gym. Unfortunately, just knowing about biases won’t make them go away. We have to design our interactions to expose and avoid them as best we can.

1). Availability Bias

The availability bias is the natural human tendency to be more biased toward information that’s easy to access mentally or the most recent information we have received.

The real-world example is of a media-company executive who refused to accept that a small number of ‘cord-cutters’ would dramatically change the media landscape. The segment of people who wanted to watch what they wanted when they wanted was only 1.75 percent of the market at the time of the meeting (2009). And so the executive dismissed cord cutters as “inconsequential.”

The executive (and his company) completely missed the trend toward streaming content.

It was challenging for executive to see the possibility of cord cutting simply because the concept wasn’t mentally accessible to them.

The last 2 years have showed us pretty much anything is possible from a postponed Olympic Games to a gymnast removing herself from the Olympics due to her mental health.

When making a decision, do your homework, take a little extra time.

2). Status quo bias

Generally, humans prefer things to stay the same. We like things to feel normal.

This bias, of course, explains why feelings of depression and anxiety have soared during the pandemic. We simply don’t like things to throw off our present reality.

In gymnastics, however, it’s important to realize that status quo bias prevents coaches from remaining competitive. For example, most coaches almost always consider the risks of launching a new training plan or possibly going in a different direction for a group at vault:

It may not work as well as we anticipate

There’s no way other coaches (or the owner of the gym) will go for it.

The parents (and possibly other coaches) are looking for immediate results.

As a result of these attitudes, coaches give up on plans which could vault them ahead. They stay within their comfort zones and avoid risk. That’s status quo bias in action. We prefer that things remain the same rather than risk a loss—an outcome that might not work out as well as expected.

Here’s the key—in a world of exponential change, we’re often taking a bigger risk by not taking action and staying in place.

3). Egocentric bias

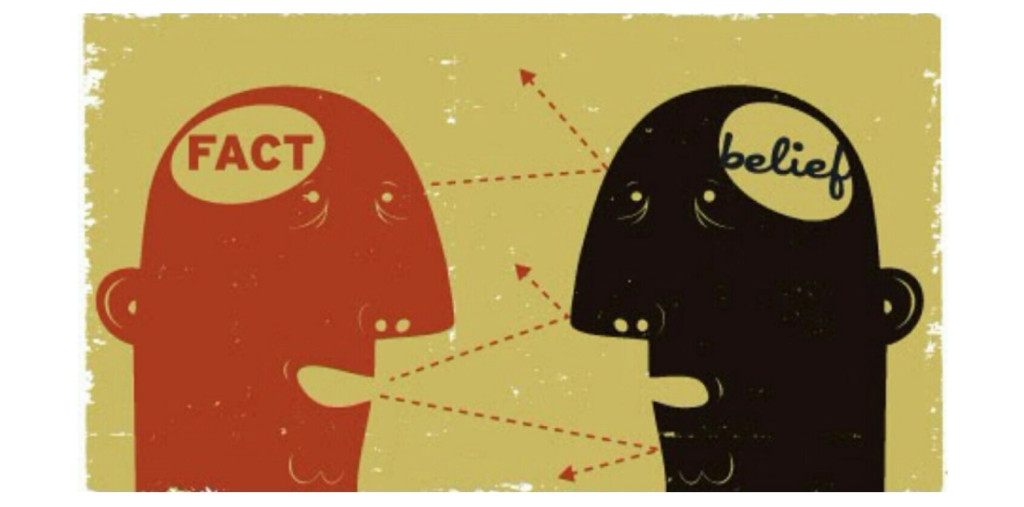

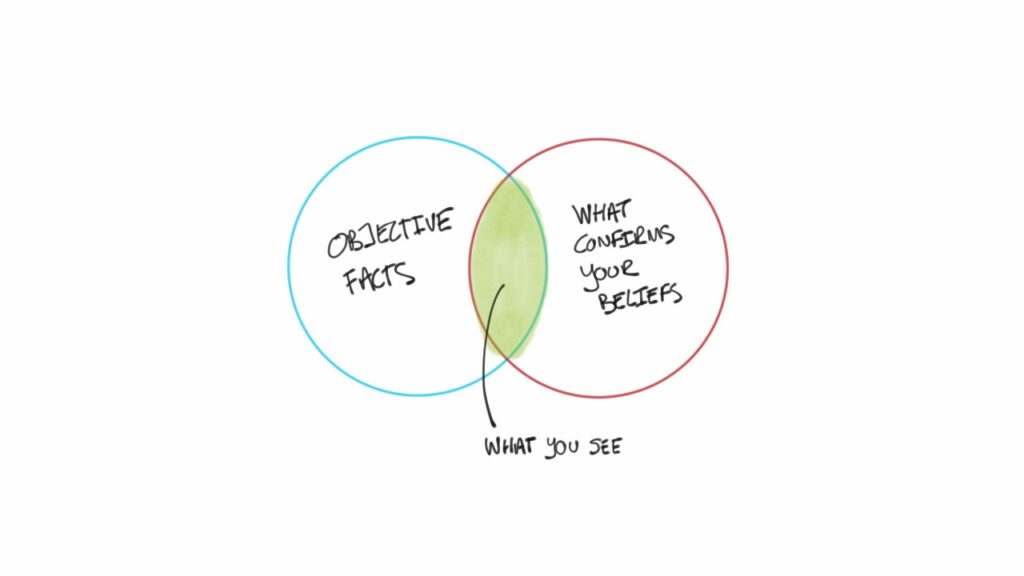

The egocentric bias means we tend to overweight our point of view over the point of view of others.

In business, leaders give in to egocentric bias when they pay more attention to data that supports their point of view and less attention to data that conflicts with it. In the gym we often look to others to validate our point of view and plan. We need people to give us other ideas. There needs to be discussion and discourse.

Since the world is a muddy place and data is often unclear, it’s harder for coaches to spot trends that don’t conform to their world view. And, as a result, they fail to incorporate that data into their decision-making.

Pay attention to diverse voices and opinions.

4). Affect heuristic bias

This bias means we pay more attention to things that spark a strong, intense emotional reaction.

For example, if we see information or data that alarm us, we are more likely to take action on it. If the data doesn’t deliver an emotional punch, we’re likely to ignore it. When did you begin to make a plan at your gym for closing, cleaning or quarantining because of the pandemic? Did you wait until it was all over the news? I did.

That’s why the media executive discussed earlier was unaffected by a market segment of just 1.75%. It simply didn’t provide a strong enough response. The problem, of course, is that by acting only on data points that provoke a strong emotional response, small (but growing) trends often go unnoticed until they’re too late.

5). Overconfidence bias

People overestimate the likelihood that they are correctly judging a situation, and they underestimate the chance that they are wrong.

It is good to have confidence BUT is your confidence justified or is it based on faulty information?

We often think our opinion is the right one. True leaders, however, acknowledge that they might be wrong. They surround themselves with people who express a diversity of opinion—and they encourage those people to express their contrarian opinions openly.

It’s said that innovators can see around corners. It’s true. They do see things the rest of us miss. But they do so because they’ve created the conditions for innovation to thrive—and those conditions start with the way they think.

When it is time to make decisions keep a few things in mind.

- Don’t Rush. Decisions thrown together at the last minute invariably include flaws that greatly affect the fairness, accuracy, and usefulness of the resulting evidence.

- Guard against unintended bias.

- Talk to a variety of people. Get contrasting points of view.

Unfortunately I cannot find the source of my notes on this. I believe it was from INC Magazine or Harvard Business Review. Apologies. When I find the source I will update.